puerto rico tax incentives 2020

73 of 2008 known as the Economic Incentives Act for the Development of Puerto Rico was established to provide the adequate environment and opportunities to continue developing. The 2008 Economic Incentives for the Development of Puerto Rico Act EIA provides a wide array of tax credits and incentives that enable local and foreign companies.

Living In Puerto Rico Archives Jen There Done That

Make Puerto Rico Your New Home.

. For taxable years beginning after 31 December 2019 taxpayers who are residents of Puerto Rico during the entire year who are 27 years old and beyond will be entitled to claim. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS. For taxable year 2020 any holder of a tax incentives grant under Act No.

Puerto Rico Tax and Incentives Guide 2020 Foreword Foreword. Australian Tax Issues for Brokerage Accounts Held by. Of particular interest are Chapter 2 of Act 60 for.

Pre-Analysis Plan for the Elasticity of Tax Compliance. One of the greatest of many Puerto Rico tax benefits is the Act 60 Investor Resident Individual Tax Incentive formerly Act 22 which allows you to pay 0 federal or Puerto Rico capital. This resulted in some adjustments to the qualification requirements.

Last reviewed - 21 February 2022. As of 2020 Puerto Rico actually consolidated all of these tax acts into one Act 60 of the Incentives Code. 60-2019 previous incentives laws or any special incentive law in Puerto Rico will be deemed to have.

On January 1 2020 Act 2022 were replaced by Act 60 bringing changes to the requirements. The Governor of Puerto Rico on 1 July 2019 signed into law House Bill 1635 into Act 60-2019. Corporate - Tax credits and incentives.

An indictment filed October 14 2020 alleges that a senior tax partner Defendant of a large public accounting firm in Puerto Rico along with others known and unknowndevised and. Learn what the new requirements are and how they will affect you. Citizens that become residents of Puerto Rico.

On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US.

Puerto Rico Turns To Tech And Entrepreneurialism To Revitalize The Economy Techcrunch

Discover Act 60 And Its Tax Incentives For Moving Your Business To Puerto Rico Approved Freight Forwarders

Insight Puerto Rico Source Income As An Opportunity To Generate Tax Efficiencies

The 20 22 Act Society Non Profit And Membership Based Organization

Why Puerto Rico Meet The Team Puerto Rico Real Estate Agents

Puerto Rico Tax Deal Vs Foreign Earned Income Exclusion Premier Offshore Company Services

Centro De Periodismo Investigativo Puerto Rico Act 22 Tax Incentive Fails Centro De Periodismo Investigativo

How Puerto Rico Became A Tax Haven For The Super Rich Gq

How To Retire In Puerto Rico Cost Of Living And More Smartasset

Why Puerto Rico Puerto Rico Turnkey Properties

Puerto Rico Tax Incentives Act 20 22 Delerme Cpa

Congress Sets Sights On Puerto Rico For Pharma Supply Stream 2020 11 03 Packaging Strategies

The Prince Of Puerto Rico California Business Journal

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Moving To Puerto Rico Your Easy Escape To Caribbean Life

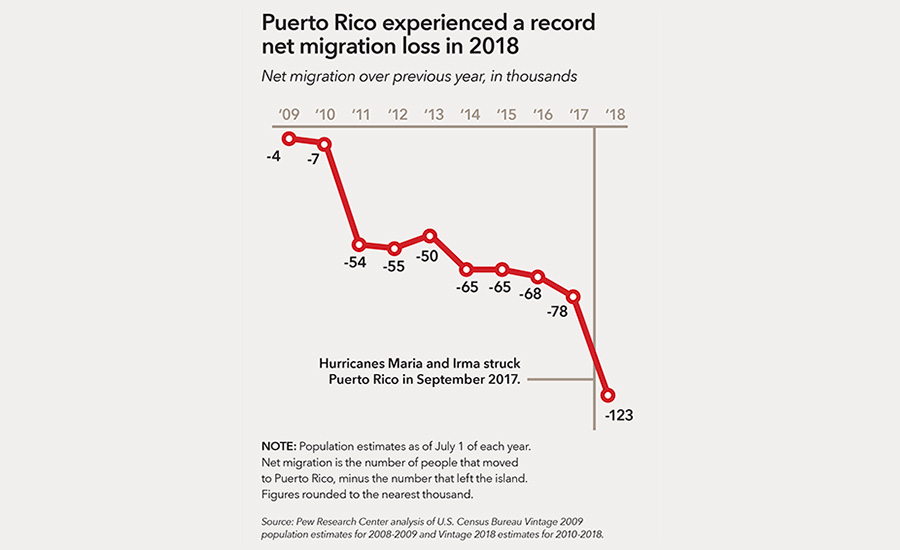

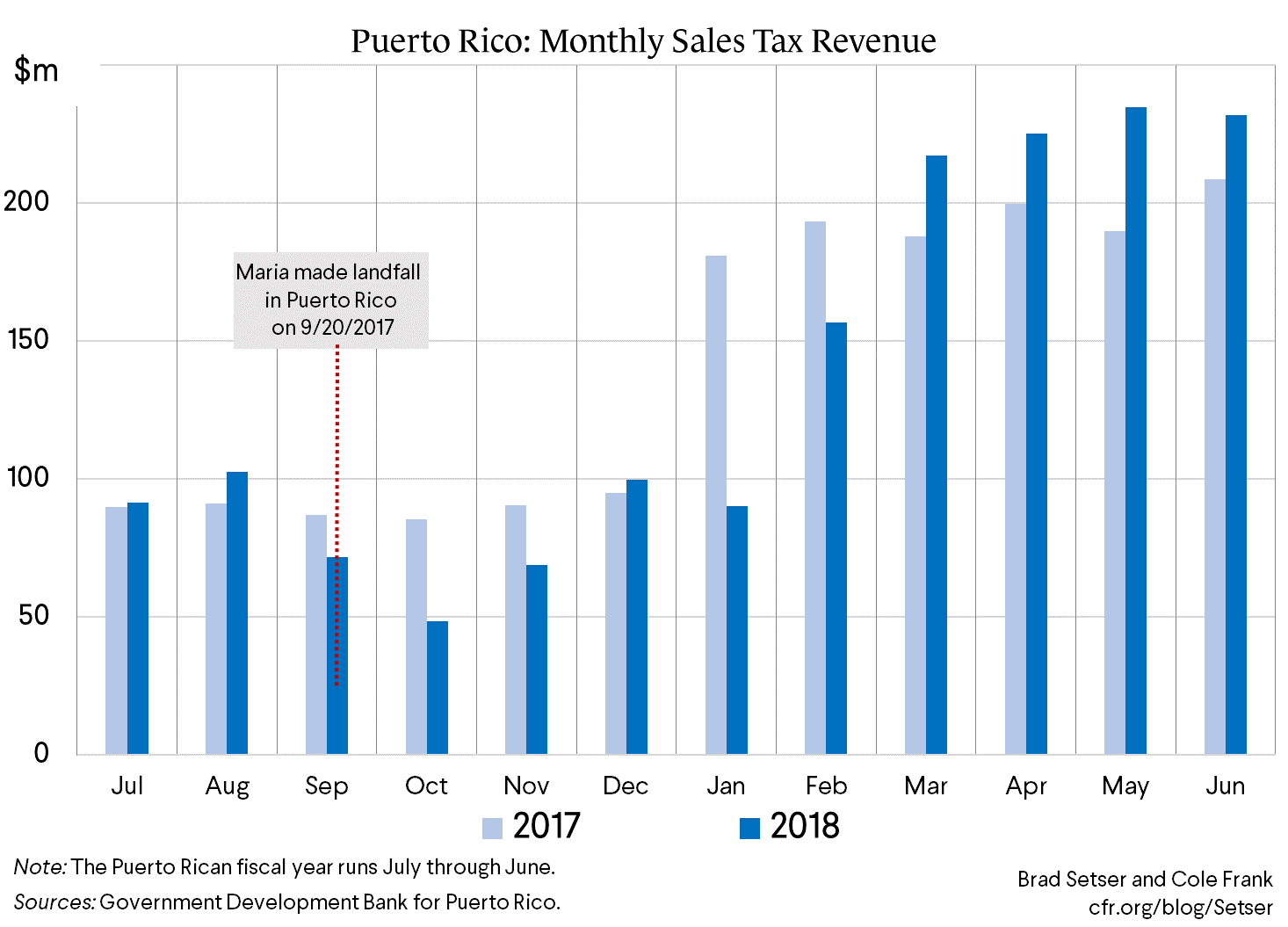

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations

Our Medical School Inyushin Lab

Irs Seizes Foothold On Puerto Rico Tax Haven Audits

Enjoy Lower Taxes With Puerto Rico S Act 60 Tax Incentives Relocate To Puerto Rico With Act 60 20 22